When you walk into a pharmacy and see two versions of the same pill-one with a familiar brand name, another with a plain label and lower price-it’s easy to assume they’re just two different generics. But what if the brand-name company itself made the cheaper version? That’s not a mistake. It’s a calculated business move called an authorized generic.

What Exactly Is an Authorized Generic?

An authorized generic is the exact same drug as the brand-name version-same active ingredients, same inactive ingredients, same pill shape, same manufacturer. The only difference? No brand name on the label. It’s sold at generic prices but comes straight from the original company’s factory. For example, when Pfizer made Celebrex, they also made an authorized generic version of celecoxib under their subsidiary Greenstone Pharmaceuticals. Same capsule. Same batch. Same quality. Just cheaper. And it’s not rare. Between 2010 and 2019, over 850 authorized generics hit the U.S. market. Many of them launched right before or during the 180-day window when the first generic company gets exclusive rights to sell a drug after a patent expires.Why Do Brand Companies Do This?

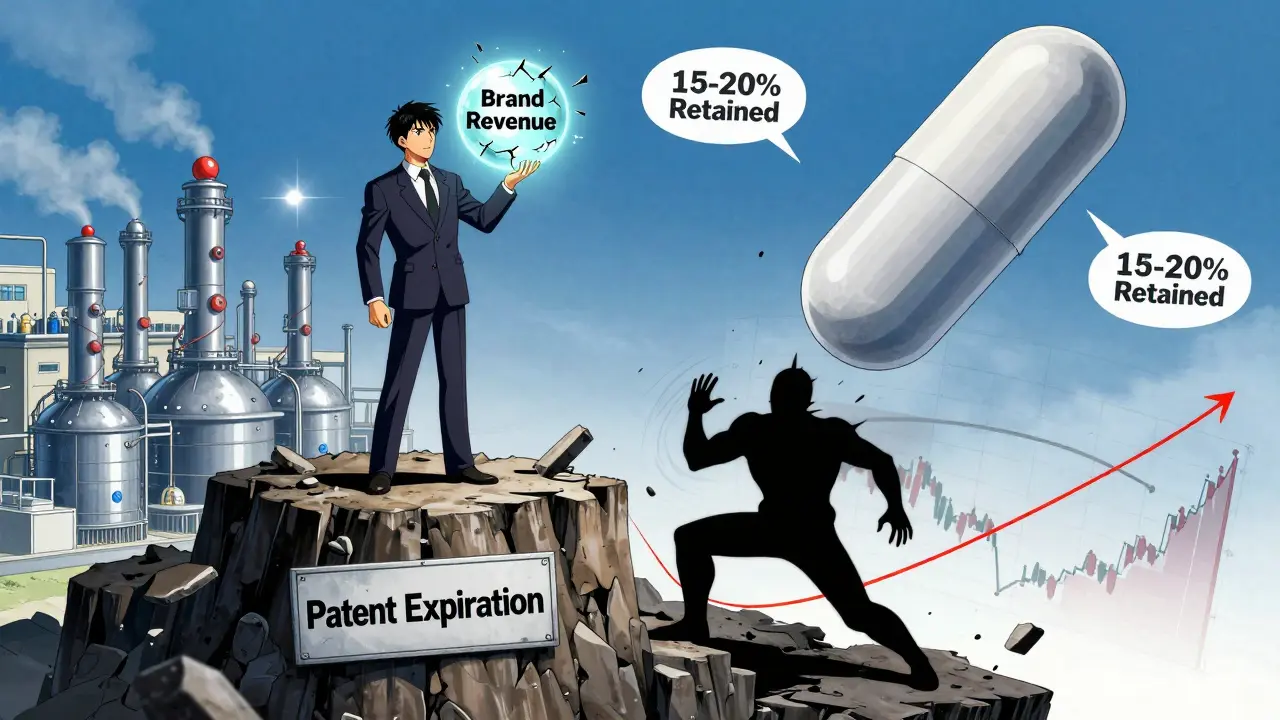

It sounds counterintuitive. Why would a company that spent millions developing a drug and building its brand turn around and sell the same thing at half the price? The answer isn’t altruism. It’s survival. When a patent expires, the brand drug’s sales typically drop 80-90% in the first year. That’s a massive revenue cliff. But if the brand company launches its own authorized generic, it doesn’t lose everything. It keeps a piece of the pie. Think of it like this: You own a popular coffee shop. A new shop opens across the street selling the exact same coffee, cheaper. You could shut down. Or you could open a second location under a no-name brand, sell the same brew for less, and keep customers who care more about price than the logo. That’s what authorized generics do.The Hatch-Waxman Act and the 180-Day Edge

The U.S. law called the Hatch-Waxman Act gives the first generic company that files to copy a brand drug 180 days of exclusive market access. That’s a goldmine. During that time, that single generic maker can charge high prices-often 30-50% below brand, but still much higher than later generics. Here’s where it gets strategic: brand companies often launch their authorized generic before or during that 180-day window. Now the generic company isn’t alone. It’s competing with its own maker. That crushes its pricing power. The Federal Trade Commission found in 2011 that when authorized generics entered the market during this exclusivity period, prices dropped significantly faster than in markets without them. Consumers win. The first generic company? They don’t get to milk the monopoly. And the brand company? They keep revenue flowing while still appearing to support lower-cost options.

Segmenting the Market Like a Pro

Brand companies aren’t just fighting generics-they’re splitting the market. They keep selling the branded version to people who don’t mind paying more: those with good insurance, older patients loyal to the name, or doctors who still prefer the original label. At the same time, they sell the authorized generic to price-sensitive customers: those on Medicare Part D, Medicaid, or paying out of pocket. This is called price discrimination-not in a shady way, but in a business-savvy one. It’s legal. It’s common. And it works. Instead of losing 100% of the market to generics, they keep 15-20% through their own authorized version. For a $1 billion drug, that means saving $150-200 million in annual revenue.Why Not Just Let the Generic Competitors Win?

Because not all generics are the same. Traditional generics only need to prove they’re bioequivalent to the brand. That means the active ingredient matches. But the fillers, dyes, and binders? Those can be different. For most drugs, that doesn’t matter. But for drugs with a narrow therapeutic index-like warfarin, levothyroxine, or seizure meds-even tiny formulation changes can cause problems. Patients on these drugs often report side effects when switching to a generic from a different manufacturer. The brand company knows this. So they offer the authorized generic as the “safe” alternative: same formula, same results, just cheaper. It’s not just about money-it’s about trust. A 2005 survey found over 80% of Americans wanted the option to buy an authorized generic. People aren’t stupid. They know if the pill looks and tastes the same, it’s probably the same.

It’s Not Just a Reaction Anymore

Ten years ago, most authorized generics launched after a generic competitor already entered the market. Today? That’s changing. New data shows brand companies are launching authorized generics earlier-sometimes even before the first generic even files. It’s a preemptive strike. They’re saying: “We know you’re coming. So we’re going to be here too. And we’ll make sure you don’t make any money.” Some companies are even using clever distribution tricks. They might sell the authorized generic only through mail-order pharmacies or specific retail chains. That way, it doesn’t directly compete on the shelf with the brand version. No price comparison. No confusion. Just two versions serving two different customer groups.What’s Next? Biologics and Beyond

The game is evolving. Now, big drugs aren’t just pills-they’re complex biologics: injectables for cancer, autoimmune diseases, and rare conditions. These cost hundreds of thousands of dollars a year. When their patents expire, biosimilars will enter the market. Brands are already thinking: “Can we do authorized biosimilars?” The FDA hasn’t officially said yes or no yet. But companies are testing the waters. If they can launch their own version of a biosimilar-same molecule, same delivery system, same manufacturer-it could change the whole game. The same strategy applies: protect revenue, control the market, and stay ahead of competitors.Who Benefits?

Let’s be clear: patients and payers win. Prices drop faster. Choices increase. The FTC and consumer groups have consistently found that authorized generics lead to lower overall drug costs. But the real winners? The brand companies. They don’t just survive the patent cliff-they navigate it with precision. They turn a threat into a strategy. They keep their factories running. They keep their employees paid. And they keep their shareholders happy. It’s not about tricking people. It’s about playing the game the way it’s written. And right now, the rules let them do it.Are authorized generics the same as regular generics?

Yes and no. Authorized generics are identical to the brand-name drug in every way-same active and inactive ingredients, same manufacturer, same quality control. Regular generics only need to match the active ingredient and prove bioequivalence. They can have different fillers, colors, or coatings. That’s why some patients notice differences when switching to a regular generic.

Why are authorized generics cheaper if they’re the same drug?

Because they don’t carry the brand name’s marketing, advertising, or R&D costs. The brand company doesn’t need to spend millions promoting it. They’re selling it as a no-frills version, so the price drops. But it’s still made in the same factory, under the same standards, with the same team.

Can I ask my pharmacist for an authorized generic?

Yes. You can ask your pharmacist if an authorized generic is available for your prescription. It’s not always automatically substituted, but many pharmacies stock them because they’re cost-effective and trusted by patients. Just say, “Is there an authorized generic for this drug?”

Do authorized generics affect how insurance covers my drugs?

Usually, insurance treats authorized generics the same as regular generics-meaning lower copays. Some plans even prefer them because they’re cheaper than the brand and more reliable than some traditional generics. Always check your plan’s formulary, but in most cases, you’ll pay less with an authorized generic.

Are authorized generics safe?

Yes. They’re made under the same FDA oversight as the brand-name drug. In fact, they’re often produced on the same production line. The FDA requires manufacturers to notify them before launching an authorized generic, but no new approval is needed because it’s covered under the original brand’s New Drug Application. If you’ve been on the brand version without issues, the authorized generic is a direct replacement.

Why don’t all brand companies use this strategy?

Not every drug is worth it. For low-selling drugs, the cost of setting up a separate distribution channel for an authorized generic might not make sense. Also, some companies prefer to exit the market entirely after patent loss. But for blockbuster drugs-especially those with high manufacturing capacity or loyal patient bases-the strategy is almost always used.

Brett MacDonald

February 3 2026so like... the brand just makes a copy of their own drug and sells it cheaper? lol. i thought generics were supposed to be other companies. guess capitalism is just one big game of musical chairs with pills.

also why does my pharmacist never mention these? probably because they get less commission on 'no name' stuff.