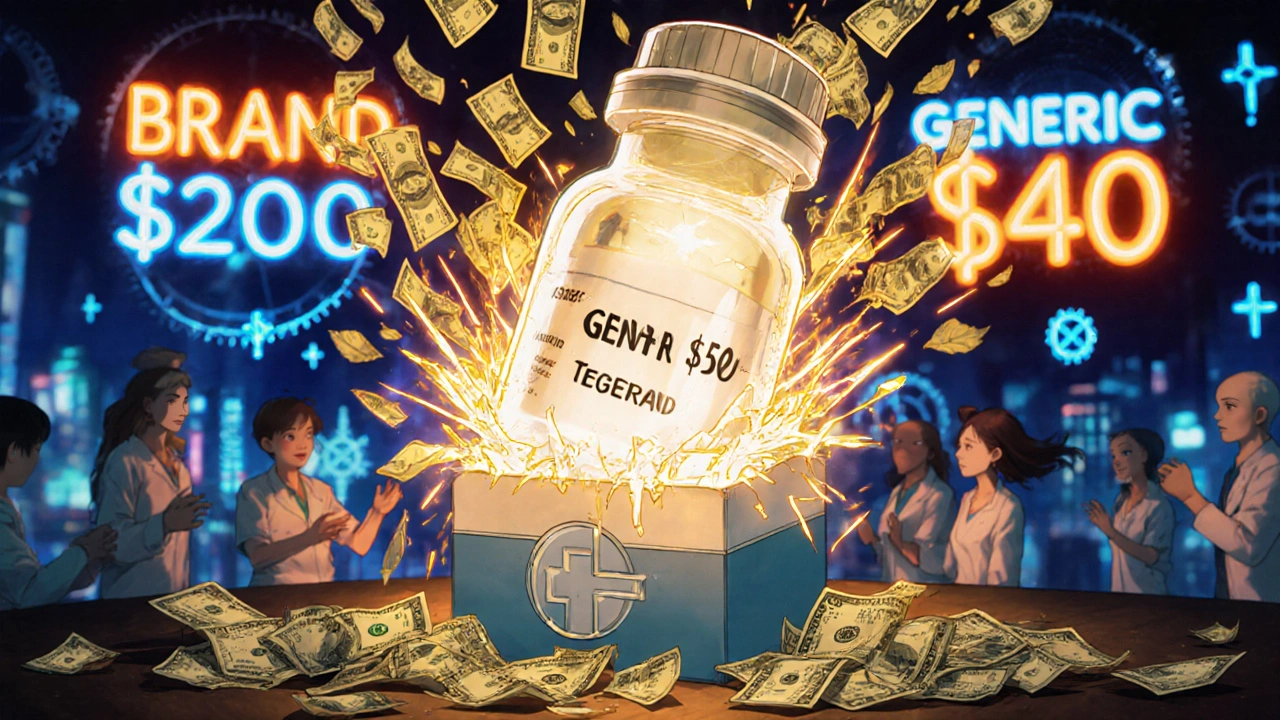

When you pick up a prescription and see a generic version on the shelf, you probably don’t think about who got there first. But behind that simple switch from brand-name to generic is a high-stakes race that can save you hundreds - or even thousands - of dollars a year. The first generic approval by the FDA isn’t just a bureaucratic milestone. It’s the moment when drug prices start to drop dramatically, competition kicks in, and real savings begin.

What Exactly Is a First Generic Approval?

A first generic approval means the FDA has accepted the very first application from a company wanting to sell a generic version of a brand-name drug after its patent expires. This isn’t just any generic - it’s the first one. And that first one gets something rare in pharmaceuticals: 180 days of exclusive rights to sell that generic without competition.

This system wasn’t always in place. Before 1984, companies wanting to make generic drugs had to repeat the same expensive clinical trials that the original maker went through. That made generics too costly to be practical. The Hatch-Waxman Act changed everything. It let generic companies prove their version worked just as well by showing bioequivalence - meaning your body absorbs the drug at the same rate and level as the brand. No need to re-prove safety. No need to re-run years of trials. Just prove it’s the same.

That’s the big deal. The FDA doesn’t approve generics based on guesswork. They require strict testing. The drug’s absorption in your bloodstream (called AUC and Cmax) has to fall within 80% to 125% of the brand-name version. Studies show the average difference between brand and generic is just 3.5%. That’s less than the variation you’d see between two different batches of the same brand drug.

Why Does Being First Matter So Much?

That 180-day exclusivity window is where the real money is. When the first generic hits the market, it’s the only option besides the brand. So it can undercut the brand’s price by 15% to 20% - and still make a huge profit because no one else is selling the same thing yet.

For blockbuster drugs that used to sell for $1 billion a year, the first generic company can walk away with $100 million to $500 million in extra profits during those six months. That’s why companies spend millions on patent challenges and legal teams just to be first.

But here’s the kicker: once that 180 days are up, other generic makers jump in. And prices don’t just drop - they collapse. Within six months of multiple generics entering, prices fall 70% to 90%. The first generic sets the tone. It breaks the brand’s monopoly. And that’s what drives down costs for everyone.

How the Process Actually Works

It’s not as simple as filing paperwork. To get first-to-file status, a company must submit what’s called a Paragraph IV certification. That’s a legal notice saying, “We believe your patent is invalid or we don’t infringe it.” That triggers a lawsuit from the brand-name company. If they sue, the FDA can’t approve the generic for up to 30 months while the court case plays out.

That’s where things get messy. Some brand-name companies use this delay tactic to block generics - even when their patents are weak. The FDA has tried to crack down, but it’s still a problem. Between 2010 and 2020, patent fights delayed first generic entry for 42% of cases.

Even if the generic wins the lawsuit, the clock for exclusivity doesn’t start until the drug is actually sold. Some companies sit on approval for months, waiting for the right moment to launch - and sometimes, they never launch at all. That’s called “evergreening,” and it’s one reason why not all first generics make it to market.

Who Benefits the Most?

Patients do. Pharmacists do. The healthcare system does.

Since Hatch-Waxman passed in 1984, generics have gone from 19% of prescriptions to over 90% today. That’s saved Americans more than $1.7 trillion. The Congressional Budget Office estimates that first generics alone save the system $13 billion a year.

Pharmacists report that 87% of patients are more likely to fill prescriptions when generics are available. And 73% say patients stick with their meds longer when they’re cheaper. One survey of 1,200 pharmacists found that the first generic of Eliquis (apixaban) caused a temporary shortage because demand spiked - and supply couldn’t keep up. That’s how powerful this first-mover advantage is.

Patients notice the difference too. On Drugs.com, first generics average a 4.2 out of 5 rating. The brand-name versions? 4.3. People say things like, “Same medicine, half the price,” and “No side effects changed.” That’s not marketing. That’s real experience.

The Dark Side: Authorized Generics and Market Manipulation

But it’s not all fair play. Sometimes, the brand-name company sells its own unbranded version - called an authorized generic - right when the first generic launches. It’s the same drug, same factory, same packaging, just no brand name. And it’s often priced just below the first generic.

This tactic cuts the first generic’s market share by 20% to 30%. It’s legal. But it’s designed to kill the exclusivity advantage before it even starts. Between 2015 and 2022, authorized generics appeared in 38% of first generic launches.

And then there’s the issue of multiple first filers. Sometimes, two or more companies file on the same day. The FDA then lets them share the 180-day exclusivity. That sounds fair - until you realize it means no one gets the full benefit. The result? Slower price drops and less savings for consumers.

What’s Changing Now?

The rules are evolving. The 2022 Inflation Reduction Act removed a loophole that let drugmakers pause the 180-day clock if the drug had special safety rules (called REMS). That means first generics can now launch faster.

Also, the FDA is speeding up approvals for complex generics - things like inhalers, creams, and injectables that are harder to copy. In 2023, 17 complex generics got first approval, up from just 9 in 2022. That’s a big deal because these drugs used to cost hundreds or thousands of dollars a month. Now, they’re becoming affordable.

And the pipeline is full. Over $156 billion worth of brand-name drugs are set to lose patent protection by 2028. That’s a wave of first generics coming - and with it, more savings.

What This Means for You

If you’re on a brand-name drug that’s about to go generic, don’t wait. Talk to your doctor or pharmacist. Ask: “Is there a first generic coming?” If yes, you might be able to switch as soon as it hits the shelves. You could save 50% to 80% right away.

And if your pharmacy says the generic isn’t available yet - ask why. Is it a supply issue? Or is the brand still blocking it? Sometimes, it’s just a matter of timing.

The first generic approval isn’t just a legal formality. It’s a turning point. It’s when a drug stops being a profit engine for one company and becomes a tool for public health. And if you’re paying for prescriptions, that’s the moment you start seeing real savings.

What does 'first generic approval' mean?

First generic approval means the FDA has approved the very first generic version of a brand-name drug after its patent expires. The company that gets this approval gets 180 days of exclusive rights to sell that generic, giving them a major market advantage before other generics enter.

Why is the 180-day exclusivity period important?

The 180-day exclusivity lets the first generic company be the only seller of that generic version. During this time, they can price the drug 15-20% below the brand and capture up to 80% of the market. This drives down prices fast and sets the stage for even deeper discounts once other generics arrive.

Are first generics as safe and effective as brand-name drugs?

Yes. The FDA requires first generics to meet the same strict standards as brand-name drugs. They must prove bioequivalence - meaning your body absorbs the drug at the same rate and level. Studies show the average difference in absorption is just 3.5%, which is less than the variation between two batches of the same brand drug.

Can the brand-name company block a first generic?

Yes, but only through legal means. The brand can sue the generic maker if they file a Paragraph IV certification challenging the patent. This triggers a 30-month legal stay that delays FDA approval. Some brands use this tactic to delay competition, even when their patents are weak - a practice known as “pay-for-delay” or patent thickets.

What’s an authorized generic?

An authorized generic is the brand-name drug sold without the brand label - made by the same company, in the same factory. It enters the market at the same time as the first generic, often at a slightly lower price. This cuts into the first generic’s profits and market share, even though it’s the same drug.

How do first generics save money?

First generics start the price drop. Within six months of their launch, prices fall 70-90%. Since 1984, generics have saved the U.S. healthcare system over $1.7 trillion. The first generic is the spark that turns a high-cost brand into an affordable option for millions.

How can I find out if a first generic is coming for my drug?

Check the FDA’s Orange Book or ask your pharmacist. Many drug manufacturers also announce upcoming generic launches. If your drug’s patent expires soon, it’s worth asking if a first generic is pending approval. Switching early can mean big savings.

Bruce Hennen

November 28 2025Let’s be clear: the FDA’s first-generic approval process isn’t some altruistic public health initiative-it’s a corporate loophole dressed up as consumer protection. That 180-day exclusivity? It’s a cartel license. The company that files first doesn’t innovate-they litigate. And the rest of us pay for it in delayed access and inflated prices until the next legal chess move.

Don’t fall for the ‘same drug’ myth. Bioequivalence isn’t identity. Some generics have different fillers, coatings, or release mechanisms that alter absorption in vulnerable populations-elderly, renal patients, kids. The FDA doesn’t test for that. They test for statistical averages. That’s not medicine. That’s math.

And don’t get me started on authorized generics. The brand makes the same pill, slaps on a white label, and sells it cheaper. That’s not competition. That’s sabotage. The system is rigged to reward legal maneuvering, not patient access.

Save your money? Sure. But don’t pretend this is fairness. It’s capitalism with a Band-Aid.